Pay attention to your paycheck after your new Form W-4 takes effect to see if results are correct for your situation. TurboTax Tip: If you itemize deductions, or receive extra income from dividends or interest, you can use the new Form-W4 to make your withholding more accurate. You only complete each section if it applies to your situation. There are now three main sections used to help determine your withholding. The new Form W-4 is a bit easier to understand because each section shows why adjustments are being made. To calculate the number of allowances, you could use separate worksheets that many found complicated.Any additional amount you wanted to be withheld from your paycheck.The number of allowances you were claiming.In 2019 and years prior, Form W-4 only required you to input: As with the prior version of the form, the new W-4 allows you to claim exempt status if you meet certain requirements.You still have to provide your name, address, filing status and Social Security number.For starters, a lot of the basics have stayed the same.

#Federal withholding tax table 2020 full

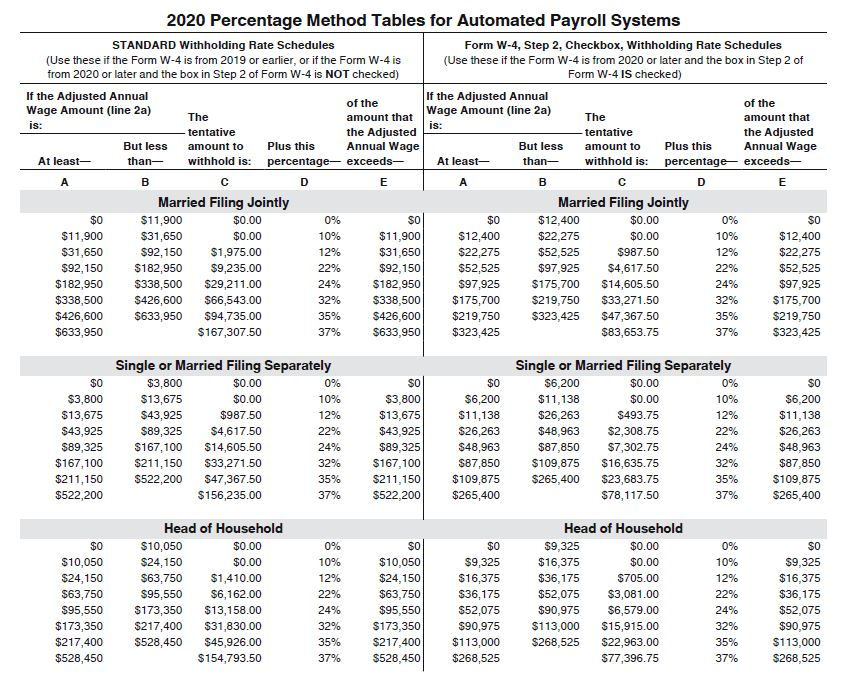

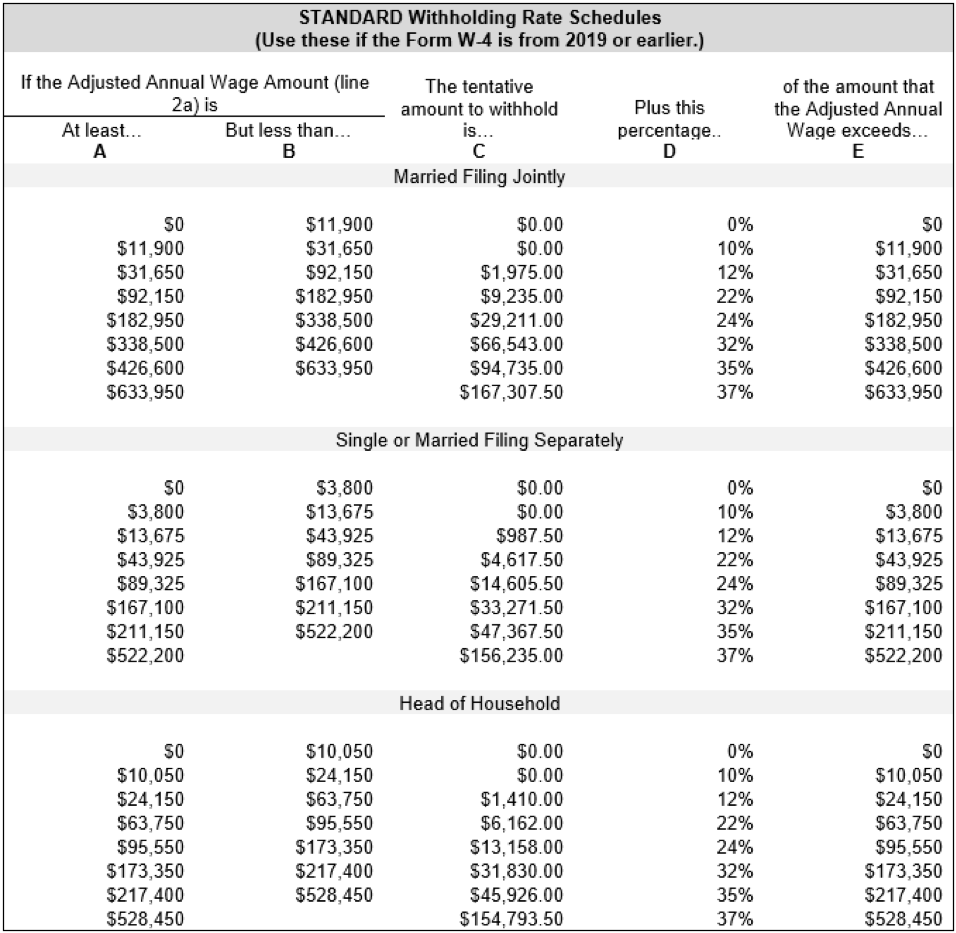

The Form W-4 is now a full page instead of a half page, and yet it's still easier to understand. Employers use these tables along with the information on your Form W-4 to calculate federal income tax withholding. The first step the IRS implemented was to change the withholding tables. When these exemptions deductions were removed in the Tax Cuts and Jobs Act, the Form W-4 no longer estimated the correct amount that needed to be withheld from paychecks as well as it used to. The allowance system was tied to the use of exemptions and deductions on your tax return.The older version relied on calculating a number of allowances that were then used, along with any additional withholding amount desired, to figure out how much federal income tax to withhold from your paycheck.However, the new tax changes don't always work well with the previous version of Form W-4. making the child tax credit available to more people.The Tax Cuts and Jobs Act (TCJA) became law in late 2017 and significantly changed how the federal income tax system works. Ideally, Form W-4 should make it so you neither owe taxes nor get a refund when you file your tax return - which is what led to it being reworked. Why the IRS made W-4 form changesĭepending on your circumstance, you might have under-withheld and owed money, or received a larger refund than usual when you filed your taxes. We'll go over the changes and what you should know. The IRS made significant changes to the W-4 form in 2020 and the updated form should provide you the means to more accurately withhold federal income tax. Your W-4 is what determines your federal income tax withholding, and making sure it's accurate is the first step in determining whether you get a tax refund or will owe taxes when you prepare your tax return.

Whether you're filling out paperwork for a new job or got an email notification from HR, you might have noticed that the W-4 form changed from what you might have been used to. This will adjust your withholding by accounting for the tax impact of the Child Tax Credit and the other dependents credits.

Form W-4 changed because the Tax Cuts and Jobs Act removed personal exemptions, increased the Standard Deduction, and made the Child Tax Credit available to more people.

0 kommentar(er)

0 kommentar(er)